Neem has raised $2.5 million in a Seed funding round from leading fintech global and local investors. This will enable Neem’s unique embedded finance platform and further its mission of bringing Financial Wellness to Pakistan’s underbanked communities – both individuals and businesses.

“The embedded finance revolution that is taking place globally in financial services is about democratisation, personalisation and access to products and services at the point of experience. At Neem, we aim to provide solutions to customers when and where they need it,” commented Nadeem Shaikh, co-founder at Neem.

Neem’s mission to bring an embedded finance model to Pakistan with a market opportunity of $167 Billion has been backed by experienced and recognised fintech investors including SparkLabs Fintech, leading investment house in Pakistan Arif Habib Ltd, Cordoba Logistics & Ventures Ltd, Taarah Ventures, My Asia VC, Concept Vines, Building Capital, Partners at Outrun Ventures and strategic angels as CSO of tech house BPC, Founding Partner at Mentors Fund, as well as fintech veteran and ex-CEO of Seccl and others.

“We have a strong conviction about Neem’s mission to enable financial wellness for underbanked communities, and have full confidence in the Neem leadership team to realise this vision amidst macro challenges across the globe,” said William Chu of SparkLabs FinTech.

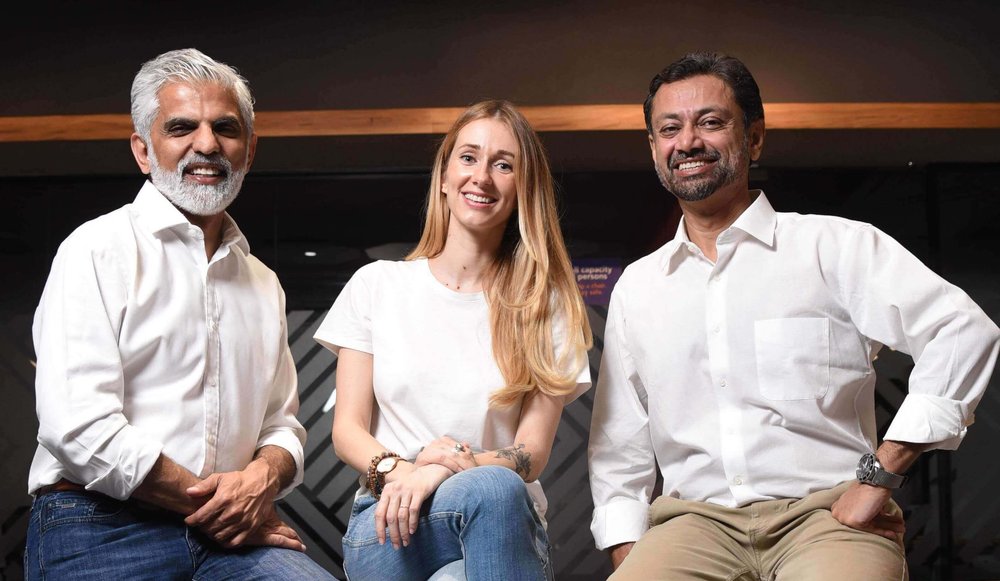

Neem has been founded by three cofounders, experienced fintech entrepreneurs, operators and ex-VC, Nadeem Shaikh, Vladimira Briestenska and Naeem Zamindar

“We are really excited about our investment in Neem which is looking to transform the financial landscape in the country. We strongly believe in Neem’s ability as a leading embedded finance platform to drive financial inclusion in Pakistan which aligns well with the core values of Arif Habib Group,” commented Shahid Ali Habib, CEO of Arif Habib Ltd.

Neem believes that financial inclusion requires a shift towards a more holistic approach catering for the full financial needs of people and businesses, a Financial Wellness model. This includes giving individuals and businesses control through payments; addressing their needs through credit; absorbing risk through access to insurance, and at the top of the financial wellness pyramid sits financial freedom through savings and investments.

“It’s time to evolve from financial inclusion to financial wellness to fully capture the shift in people’s financial needs. We simply have to move beyond providing just access to a bank account. This has been recognised also by global players like M-PESA. The paradigm shift toward financial wellness is now possible thanks to the emergence of new business and technology models,” said Vladimira Briestenska, co-founder at Neem.